- You are here:

- Home »

- Reviews

- » CreditRepair.com Review

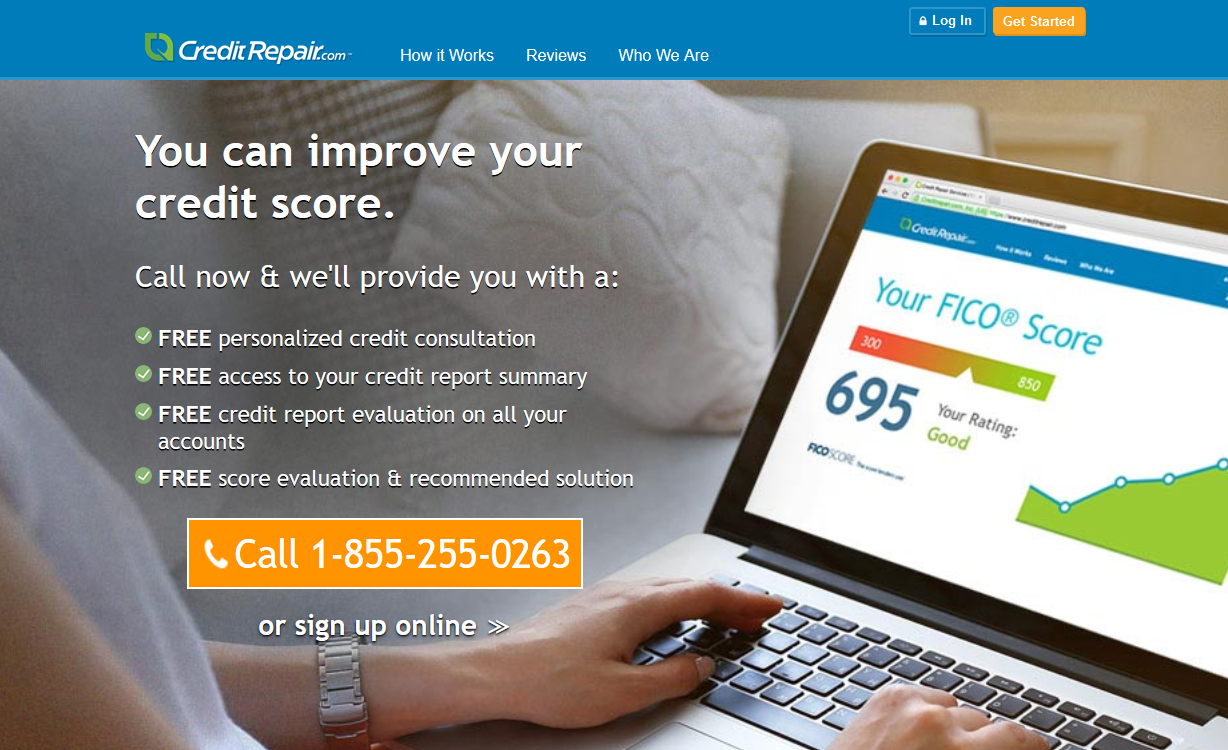

CreditRepair.com Review

Creditrepair.com is an online company designed to help you repair your credit. They’ve partnered with TransUnion and Equifax, two major credit bureaus, to help you with repairing your credit.

They help with credit information, such as balances and limits, as well as:

- Charge offs

- Bankruptcies

- Late payments

- Judgments

- Liens

- Identity Theft

- Unauthorized Inquiries

How Does It Work?

Creditreport.com operates according to a three-step process.

First, they pull your credit reports and organize it so that you can view it and more easily identify what items you want to change or challenge. Then, once they’ve figured out a game plan to fit your goals, they deal with the credit bureaus for you. They challenge items, calling on their knowledge of the law in order to ensure the best representation for you. And finally, they allow you to view the changes as they happen. They have mobile apps available as well as texts and e-mail alerts, as well as a slew of online tracking options to make sure that you are kept up to date on your credit repair process.

Can I Do It On My Own?

Yes! Of course you can! You can repair your credit on your own. You do not, strictly speaking, need outside help to try to repair your own credit. However, that being said, it does help to have someone on your side that is familiar with the statutes that are most likely to help you get the most items removed from your credit. Also, outside there definitely being something to be said about having someone trained in credit repair on your side to help you out, there’s even more to be said to having a lawyer on your side. It’s a sad fact of life that a lot of companies will try their best to take advantage of the average person, but will fold like wet paper when confronted with a lawyer.

How Much Does It Cost?

Creditreport.com charges $89.95 a month for their services. Now, this is cheaper than hiring a personal lawyer. And, while you are capable of trying to repair credit on your own, it’s tough to beat having a team working for you that is knowledgeable about credit repair and what parts of the law they can use to best help you.

So, Should I Use It?

It depends on your situation. If you’re wanting to dispute items on your credit report or need help with bankruptcy or tax liens, or other major credit issues, than this might be a good path for you. If you only have one charge that you want to dispute, however, then this doesn’t seem to be the best plan. It really depends on what your credit looks like and how much you’re willing to spend.