QuickenLoans.com Review

Quicken loans (found at quickenloans.com) is America’s largest online lender. They are an online company that’s been around for almost three decades. According to their website, they’ve been ranked “highest in Customer Satisfaction for Primary Mortgage Origination” in the U.S. for three years in a row. What that basically means, is that they’re a company […]

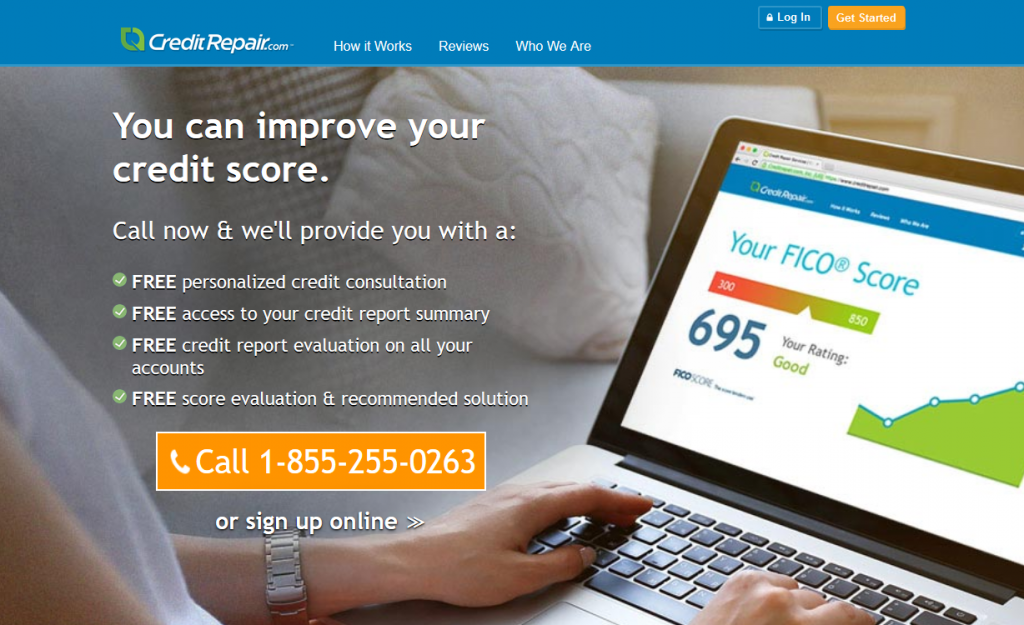

Continue readingCreditRepair.com Review

Creditrepair.com is an online company designed to help you repair your credit. They’ve partnered with TransUnion and Equifax, two major credit bureaus, to help you with repairing your credit. They help with credit information, such as balances and limits, as well as: Charge offs Bankruptcies Late payments Judgments Liens Identity Theft Unauthorized Inquiries How Does […]

Continue reading6 Steps To Improving Your Credit Score In 12 Months Or Less

A good credit score can be your ticket to the good life – lower interest rates, less deposit requirements, preferential treatment for loans and even rentals. On the other hand, having a bad credit score can be the financial equivalent of being a leper. Luckily, increasing your credit score isn’t very hard. Lets say, for […]

Continue reading5 Ways to Identify a Serious Homebuyer

Any time that a potential homebuyer shows interest in your property, it can get your hopes up. Unfortunately, just because a buyer expresses interest does not mean that they are serious about making an offer. In fact, they may not be serious even if they do make an offer, especially if they make a lowball […]

Continue readingHow to Pay Off Debt FAST Using the Snowball Method

Are you up to your eyeballs in debt? Stressed out because your payments are as large as your paycheck? You’re not alone. The average American carries more debt, especially student loans, than at any other point in history. However, there is a way out. If you want more of your paycheck to land in your […]

Continue readingChecking Your Credit Score Online – Who Do I Trust?

It’s that time again! Perhaps you’re looking to apply for a new car loan, purchase a home or maybe looking to add on an addition to your existing home. There are many reasons you may want to check your credit score. But, with so many sites out there and so many being added each and […]

Continue reading5 Things You Should Know Before Applying For A Car Loan

The world of car sales is a world of blurred price points and sometimes blurred morals. The cliché idea of a car salesman is a loud, fast-talking swindler who wants to take your money and send you on your way. Before you apply for a car loan, you should know how to handle yourself in […]

Continue readingGetting a Loan to Pay Off Credit Cards is a Bad Idea

Getting a loan to pay off credit cards – Not a great idea. Financial advisors and investing hobbyists will all tell you the same thing… in more cases than not it is a bad idea to pay off a credit card debt with another loan. It’s certainly attractive, and many loan companies will make it […]

Continue reading